Tariff Shock: Forecasts for the US, Mexico, Canada, Italy and Japan

In the wake of escalating global trade tensions and a renewed wave of tariff impositions, CAPE Economic Research and Consulting conducted an in-depth analysis to assess the inflationary impact of the U.S. tariff shock. The findings reveal that the tariff-induced shock results in a modest but sustained rise in U.S. inflation. Specifically, annual inflation is projected to average 2.9% in 2025 and edge slightly higher to 3.0% in 2026. This upward pressure is largely attributed to the pass-through of higher import costs—especially for intermediate goods—into final consumer prices. Additionally, the inflationary effects are compounded by second-round impacts, including a tightening labor market and mounting wage pressures, which further amplify consumer price increases.

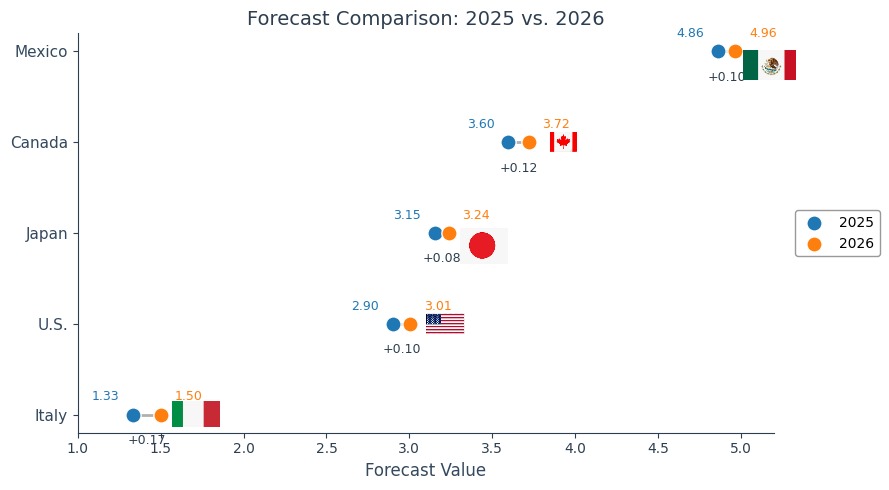

Figure 1: Annual Inflation Forecasts

Source: CAPE Economic Research and Consulting, 2025

Canada’s diversified export base and flexible exchange rate provide partial insulation from external shocks. Monthly inflation scenarios show moderate increases, particularly in tradable goods, while nontradable inflation remains relatively stable. On an annual basis, inflation is projected to rise modestly above baseline, though to a lesser extent than in Mexico, reflecting Canada’s greater capacity to source imports from alternative markets and its more responsive exchange rate passthrough.

Our baseline scenario forecasts inflation in Canada reaching 3.5% in 2025, followed by a slight uptick to 3.7% in 2026 (Figure 1). These projections suggest that the Bank of Canada may pursue a cautious tightening path, balancing mild imported inflation pressures with the ongoing need to support domestic demand recovery.

Mexico’s high trade exposure to the U.S. amplifies the inflationary impact of new tariffs. Monthly forecasts indicate a sharp initial spike in inflation during the quarters following tariff implementation, primarily driven by rising costs of imported inputs in the manufacturing and food sectors. While inflation is expected to gradually converge toward trend, it will likely remain above the pre-tariff baseline on an annual basis. Our projections show Mexico’s inflation rising to 4.8% in 2025, followed by a slight increase to 4.9% in 2026. This outlook suggests that Banxico may need to frontload interest rate hikes or implement macroprudential measures to contain imported inflation and protect real incomes, particularly among lower-income households.