Nigeria’s Economic Update

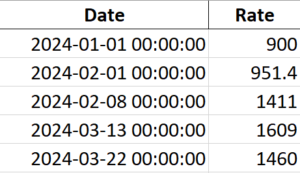

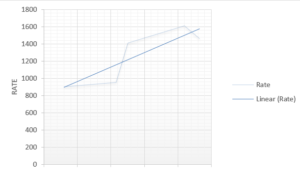

Nigeria’s economic scene in 2024 continues to capture the attention of both local and global observers. Amidst a backdrop of challenges, including a persistent shortage of foreign currency liquidity that has seen the Naira experience significant fluctuations against major currencies, there emerges a narrative of resilience and strategic intervention. The exchange rate of the Naira to the US dollar, a critical economic indicator, has been a particular focus. From the stability seen at the beginning of February with rates around 951.4 NGN per USD, to a peak rate of 1,609 NGN in mid-March, the journey has been tumultuous. However, by March 22, a noteworthy moderation to 1,460 NGN for buying and 1,485 NGN for selling per USD was observed. This adjustment is more than just numbers; it signifies the positive impact of various short-term actions undertaken by the government and the Central Bank of Nigeria (CBN) to stabilize the currency and, by extension, the economy.

These measures, including efforts to clear the foreign exchange backlogs which saw the CBN clearing $2 billion of forex backlog and releasing significant amounts to foreign airlines, are indicative of a proactive approach towards restoring investor confidence and achieving relative stability in the forex market. Such steps are essential not only for the economic markers they directly affect but also for the signal they send about the Nigerian government’s commitment to addressing the current economic challenges.

The situation also shines a light on the broader economic environment. With “unprecedented inflation” at 30%, primarily driven by soaring food prices and contributing to a severe cost-of-living crisis, the challenges are stark. Yet, the government, under President Bola Ahmed Tinubu’s leadership, is not standing by idly. The signing of memorandums of understanding (MOUs) with nations like Qatar across various sectors highlights a strategic pivot towards leveraging international partnerships to bolster economic prospects.

Furthermore, the resilience of Nigeria’s equities market in 2024, amidst these economic oscillations, speaks to the complex yet promising economic landscape. This scenario underscores the crucial balance the CBN seeks to maintain between fostering economic growth and ensuring price stability. The upcoming 294th session of the Monetary Policy Committee (MPC) meeting is set against this backdrop, holding significant implications for the nation’s economic policy direction.

Despite the immediate challenges, Nigeria’s potential for growth and development remains immense. Opportunities in gas projects, agricultural exports, and infrastructure development present avenues for leveraging the country’s rich resources and human capital. The government’s efforts, coupled with strategic global collaborations, offer a path towards a more stable and prosperous economic future.

In essence, the recent moderation in the exchange rates by March 22 reflects the positive impact of government and CBN interventions, serving as a beacon of potential stability and growth. As Nigeria navigates through these economic challenges, the strategic measures implemented and the upcoming decisions by the CBN’s MPC will be critical in shaping the country’s economic trajectory towards sustainable development and prosperity.